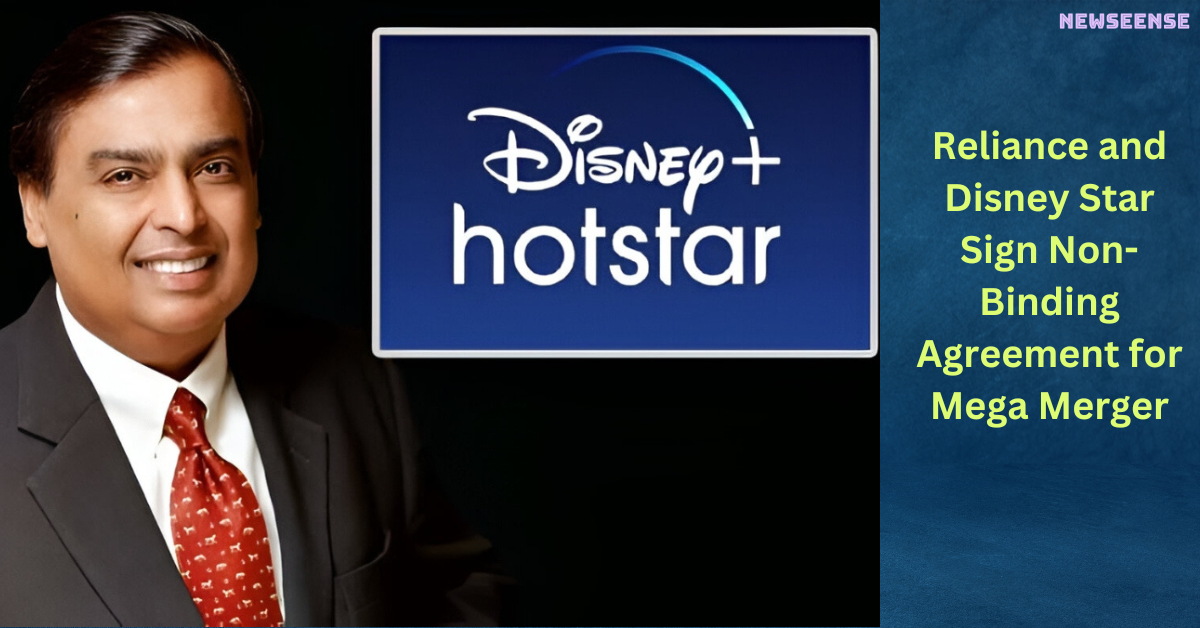

Reliance and Disney Star Sign Non-Binding Agreement for Mega Merger

In a significant step towards the largest entertainment merger in India, Reliance and Disney Star have inked a non-binding agreement in London. The much-anticipated mega-merger between Reliance, led by Mukesh Ambani, and Disney is slated to be finalized in February 2024, as per the terms of this agreement.

Table of Contents

Despite Reliance’s desire to expedite the merger’s finalization in January, several details remain to be ironed out. The non-binding agreement follows months of negotiations led by Ambani’s close aide, Manoj Modi, and Disney’s Kevin Mayer, a recent addition to the company’s executive team, according to a confidential source.

The potential merger between Reliance and Disney holds the promise of transforming the entertainment landscape in India, particularly in the realm of the nation’s most-watched sport – cricket.

Key Highlights of the Reliance-Disney Star Deal

- This deal is poised to be the most extensive entertainment merger in India, with the merged entity enjoying equal control from both Reliance and Disney. The board of directors will have an equal representation from both companies.

- The primary objective is to establish a subsidiary of Viacom18, owned by Reliance, absorbing Star India through a stock swap.

- Mukesh Ambani’s Reliance is set to become the majority shareholder in the merged entity, holding a 51% stake, while Walt Disney Co. will own the remaining 49%.

- Reliance’s OTT platform, Jio Cinema, and Disney + Hotstar are integral components of the deal, with expectations that the merger will uplift Hotstar amid ongoing losses.

- Both Reliance and Disney Star plan to invest over $1.5 billion in the deal, enabling Ambani’s firm to gain distribution control over Star India’s channels.

- Beyond TV channels and OTT platforms, the Reliance-Disney deal aims to leverage advertising prowess, particularly during India’s cricket season.

- Disney Star’s keen interest in the deal is attributed to the intense bidding wars between the two entities for cricket streaming rights. The US-based company is also seeking to enhance its presence in the Indian market.

- While Reliance assumes the role of the controlling party in the merger, Disney anticipates significant benefits, considering the profitability of its TV channels in India compared to its other entities.

- The board of directors is expected to include Mukesh Ambani’s eldest son, Akash Ambani. Another top contender is Uday Shankar of Bodhi Tree, holding the largest shares in Viacom18 after Reliance.

- While details about the new entity post-merger remain scarce, it is anticipated to be a formidable competitor for streaming services like Netflix and Amazon.

As the merger progresses, it holds the potential to reshape the entertainment landscape and viewer experience in India, with a specific focus on the widely followed sport of cricket.

Also read: https://newseense.com/au-small-finance-bank-revolutionizes-banking/

2 Comments